Ever thought of how you can determine how much time investment would take to double up the given rate of interest which is annually fixed. Don’t worry as today we are going to share a story about the same on how you can do this by the rule of 72.

It would be helpful for all of us by using the rule of 72 which makes a hectic process of getting to know about the number of years it would take to double your money and is it an easier investment to make or a debt.

But before moving any further let’s just take a look at some questions of what rule 72 is? How does it work? , etc.

What is the meaning of Rule 72?

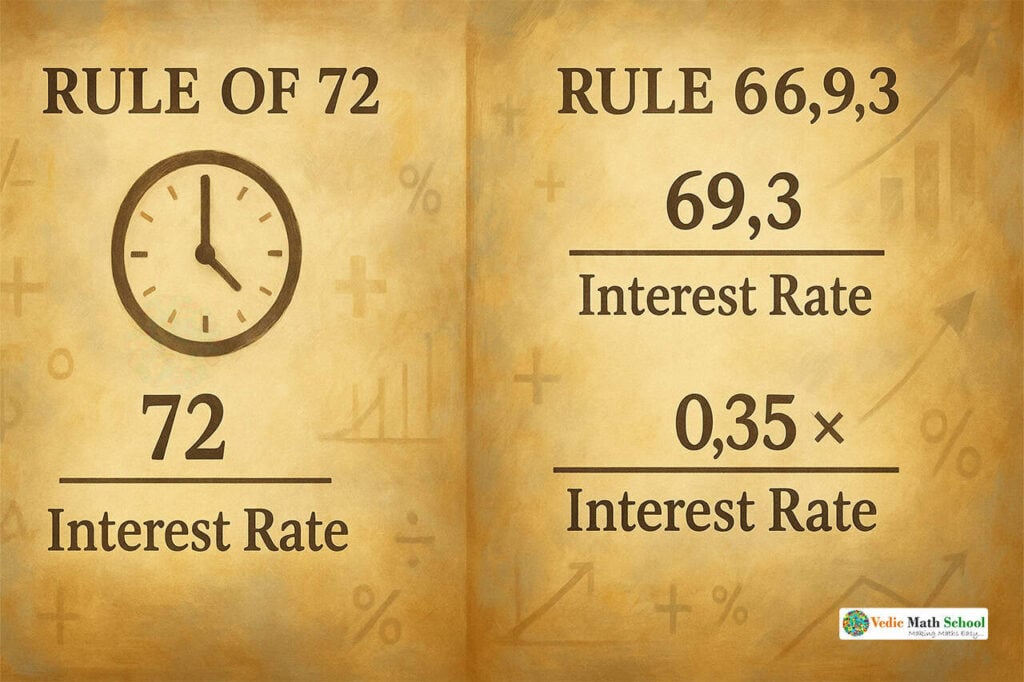

The rule of 72 is a simple way of finding out how long an investment would take to double up with the given rate of interest which is annually fixed. It’s very simple if you divide 72 by the fixed annual rate of return then through this the investors or bankers would give you an estimated rough idea of how many total years it would take the initial outlay to duplicate or generate itself.

How Does the Rule of 72 Work?

If actually, we look into the rule precisely it is more reasonable for the low rates of returns. Say for example the interest rate of 6% and now if we see the doubled money which is (72/6 = 12 years). So if the rate of interest is 6% then the investment would take a total of 12 years to double up. It was a quite simple right?!

Read more: why is 6174 the magic number?

Let’s take one more example with the interest rate of 12% and let’s see how this one goes (72/12 = 6 years) so if the interest rate is 12% then it would take a total of 6 years to double up your investment.

Note: the rule of 72 although gives us an estimated result but it is less accurate as of the rate of return increases.

For Higher Accuracy How to Use the Rule

The rule o is more precise if it is adjusted so that the resemblance would be more close to the compound interest formula. This adequately will transform the rule of 72 into the rule of 69.3 which is how we can adjust higher accuracy in the interest rates.

And this is also a theory because a lot of investors and bankers would rather use the rule of 69.3 than using the rule of 72. If you want in particular continuous compounding rates of interest you should try and use the rule of 69.3 for better results.

Read more: The story of Hardy-Ramanujan number ‘1729’

Calculating it by using Matlab

I know you all would be wondering what is the meaning of “Matlab” over here so simply stating the rule of 72 in Matlab is required to run a simple command which is “years = 72/return” now what does that mean? Here the word “years” is the outcome of the rule of 72 and “return” is this variable is the return rate of investment.

Read More : Seventeen Facts You must know about the Number 19

This rule of 72 has also been used to identify how long it can take the money to distribute equally into the value for the given inflation rate. Say if the inflation rate is 4% command of “years = 72/inflation (not return)”. Here the inflation rate is defined as inflation = 4 and it gives “18 years”.

Conclusion

So, this was all about the rule of 72 and how you can check how much time investment would take to double up your investment. Here also it includes math but it is fun to solve it and very easy as well right? It’s magic until you understand it and its mathematics thereafter.

Read More : Seventeen Cool Fact about Eighteen

Let us know your thoughts about it in the comments and stay tuned for more of such interesting math stories. Hope you’ll enjoy reading this article today thank you!